The Impact of Economic Indicators on Investment Decision Making

In the realm of finance, investment decision making is a complex process that requires a deep understanding of various factors. Among these factors, the analysis of economic indicators holds significant importance.

Introduction

In the realm of finance, investment decision making is a complex process that requires a deep understanding of various factors. Among these factors, the analysis of economic indicators holds significant importance. Economic indicators serve as statistical measures that provide insights into the current and future state of an economy. These indicators play a crucial role in influencing investment decisions, as they offer valuable information about the overall health and performance of an economy. This article delves into the impact of economic indicators on investment decision making, exploring key indicators that investors should consider.

Understanding Economic Indicators

Economic indicators encompass a range of statistical measures that are utilised to assess the state of an economy. These indicators provide information on diverse aspects of economic activity, including employment, inflation, GDP growth, consumer spending and business confidence. By analysing these indicators, investors can gain a comprehensive understanding of the economic climate, enabling them to make well-informed investment decisions.

Impact of Economic Indicators on Investment Decision Making

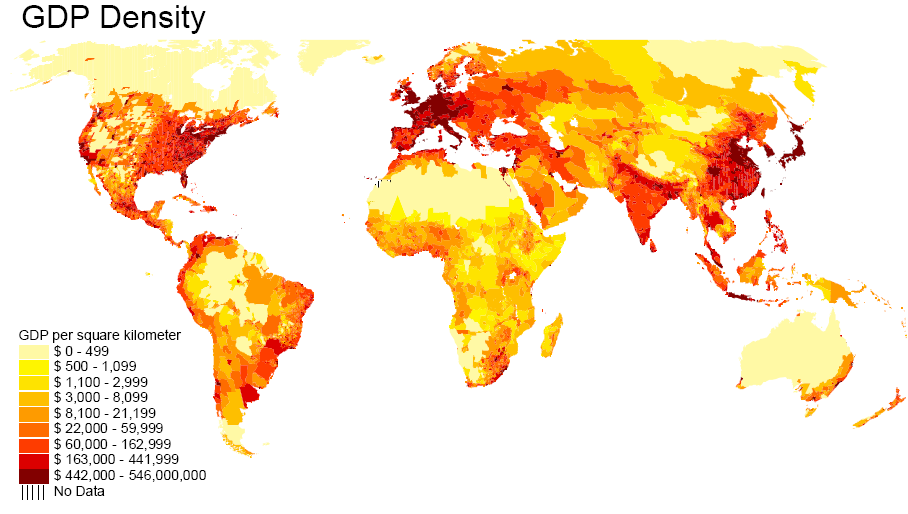

Gross Domestic Product (GDP) Growth: GDP growth is a fundamental economic indicator that investors closely monitor. It represents the total value of goods and services produced within an economy over a specific period. A higher GDP growth rate indicates a thriving economy with increased business opportunities and potential for higher returns on investment. Investors often prefer to allocate their funds in countries or regions with strong GDP growth rates, as they offer promising investment prospects.

Interest Rates: Interest rates, set by central banks, serve as a tool to control inflation and stimulate economic growth. Changes in interest rates significantly impact investment decisions. Lower interest rates tend to encourage borrowing and investment, as the cost of borrowing decreases. This can stimulate economic activity and increase investment opportunities. Conversely, higher interest rates can discourage borrowing and investment, as the cost of borrowing rises. Investors closely monitor interest rate fluctuations to assess the attractiveness of different investment options.

Inflation: Inflation refers to the rate at which the general level of prices for goods and services is rising, eroding purchasing power. Inflation has a profound impact on investment decisions, as it can erode the value of investments over time, reducing their real returns. Therefore, investors carefully consider the inflation rate when making investment decisions. Investments that provide a hedge against inflation, such as real estate or commodities, may be favored during periods of high inflation.

Employment Data: Employment data, including the unemployment rate and job creation numbers, provide insights into the health of the labor market. A low unemployment rate and steady job creation indicate a robust economy with increased consumer spending power. These factors can have a positive impact on investments in sectors such as retail, housing and consumer goods. Conversely, high unemployment rates and job losses may lead to decreased consumer spending, negatively affecting certain industries.

Consumer Confidence: Consumer confidence reflects the sentiment and willingness of consumers to spend. High consumer confidence levels indicate a positive outlook on the economy, which can boost investment in sectors such as retail, hospitality and leisure. When consumers are confident about the economy's future, they are more likely to make significant purchases and investments. On the other hand, low consumer confidence can lead to decreased consumer spending, impacting certain industries negatively.

Business Confidence: Business confidence measures the sentiment and expectations of business owners and managers. High business confidence levels often result in increased investment and expansion plans, signaling a positive economic outlook. Investors may consider allocating their funds to sectors that are likely to benefit from increased business activity, such as manufacturing, technology and infrastructure.

Conclusion

Economic indicators play a critical role in investment decision making. By analysing indicators such as GDP growth, interest rates, inflation, employment data, consumer confidence and business confidence, investors can gain valuable insights into the overall economic climate. These insights help investors make informed decisions about asset allocation, sector preferences and risk management. It is essential for investors to stay updated on economic indicators and their impact to make sound investment decisions in an ever-changing economic landscape. By leveraging the power of economic indicators, investors can navigate the complexities of the financial markets and optimise their investment strategies for long-term success.

Note: This article is for informational purposes only and should not be considered as financial advice. Always do your own research and consult with a qualified financial advisor before making any investment decisions.