Investing in Emerging Markets: Opportunities and Risks

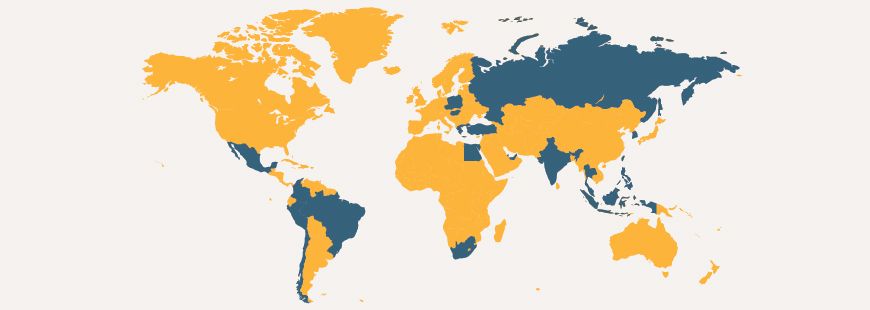

Investing in emerging markets has gained significant attention from investors seeking diversification and potential high returns. These markets, encompassing countries such as Brazil, China, India and South Africa, offer unique opportunities but also come with inherent risks.

Introduction

Investing in emerging markets has gained significant attention from investors seeking diversification and potential high returns. These markets, encompassing countries such as Brazil, China, India and South Africa, offer unique opportunities but also come with inherent risks. In this article, we will delve into the opportunities and risks associated with investing in emerging markets, exploring various factors that investors should consider.

Opportunities

High Growth Potential

Emerging markets present attractive growth potential due to several factors. Firstly, these economies often have young and rapidly expanding populations. This demographic advantage leads to increased consumer demand, driving economic growth and creating opportunities for businesses to flourish. Additionally, emerging markets often experience a rise in the middle class, resulting in higher disposable incomes and greater consumption. This, in turn, can lead to increased revenues and profits for companies operating in these markets.

Untapped Markets

Emerging markets frequently offer untapped markets with limited competition. This provides a unique opportunity for companies to establish a strong market presence and capture significant market share. By entering these markets early, companies can gain a competitive advantage and position themselves for long-term growth. Furthermore, emerging markets often have distinct needs and preferences, allowing companies to tailor their products and services to cater specifically to these markets.

Access to Natural Resources

Many emerging markets boast abundant natural resources such as oil, gas, minerals and agricultural products. Investing in companies operating in these sectors can provide exposure to these resources and potentially benefit from their increasing demand and value. However, it is crucial to consider the sustainability and environmental impact of such investments, as well as geopolitical factors that may affect resource availability and extraction.

Favorable Demographics

Emerging markets typically exhibit favorable demographics, characterised by a large young population. This demographic advantage plays a vital role in driving consumption and economic growth. As the young population enters the workforce and increases its purchasing power, there is a surge in demand for goods and services. This presents an opportunity for businesses to tap into this growing consumer base and generate substantial revenues.

Risks

Political and Regulatory Risks

Investing in emerging markets entails exposure to political and regulatory risks. These markets often have unstable political environments, with frequent changes in government policies and regulations. Political instability can lead to economic uncertainty, affecting investor confidence and potentially jeopardising investments. Additionally, corruption and bribery issues may be prevalent in some emerging markets, further complicating the investment landscape. Investors must carefully assess the political and regulatory climate of a particular market to mitigate potential risks.

Currency Volatility

Currency volatility is a significant risk associated with investing in emerging markets. Fluctuations in exchange rates can significantly impact investment returns. Emerging market currencies are often more susceptible to volatility due to factors such as economic instability, inflation and geopolitical events. Investors need to consider the stability of the local currency and potential hedging strategies to manage currency risks effectively.

Lack of Transparency

Emerging markets may exhibit limited transparency compared to developed markets. Companies operating in these markets may have less stringent reporting requirements, making it challenging for investors to obtain accurate and reliable information. This lack of transparency can increase the risk of fraud, mismanagement and inadequate corporate governance practices. Investors must conduct thorough due diligence and seek reliable sources of information to make informed investment decisions.

Liquidity Risks

Investing in emerging markets may present liquidity risks. These markets often have lower trading volumes and limited market depth compared to developed markets. As a result, it can be challenging to buy or sell securities at desired prices, particularly during times of market stress. Illiquidity can impact the ability to exit positions or adjust investment strategies, potentially leading to unfavorable outcomes. Investors should carefully consider the liquidity of the market and the potential impact on their investment strategy.

Economic and Financial Risks

Emerging markets are susceptible to economic and financial risks, including inflation, interest rate fluctuations and economic downturns. These risks can have a significant impact on investment returns and the overall stability of the market. Additionally, emerging markets may face challenges related to infrastructure development, inadequate legal frameworks and limited access to financing. Investors need to assess the macroeconomic factors and financial stability of a particular market before making investment decisions.

Conclusion

Investing in emerging markets offers opportunities for growth and diversification, but it also comes with inherent risks. High growth potential, untapped markets, access to natural resources and favorable demographics are some of the key opportunities that attract investors to these markets. However, political and regulatory risks, currency volatility, lack of transparency, liquidity risks and economic and financial risks pose challenges that need to be carefully managed. Thorough research, due diligence and a disciplined approach to risk management are essential for investors seeking to capitalise on the long-term growth potential of emerging markets.

Note: This article is for informational purposes only and should not be considered as financial advice. Investors should consult with a qualified financial advisor before making any investment decisions.